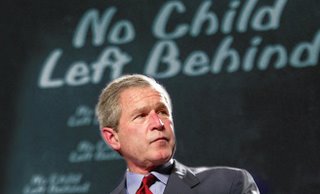

Education aside, today’s America  is setting new standards on other fronts – drug abuse, single parenthood, teen pregnancy, youth delinquency, homicide, and suicide are rampant and ubiquitous. And these are some of ‘the’ very reasons of such below average student performances, as the institution of family – just like a school– is pivotal in shaping an individual. No matter how much is invested, a fractured family at best can give a fractured individual. So, howsoever benevolent the vision, blindly investing more and more in education, and that too in meaningless ancillary services like transport, meals, housing et al (US spends on an average double on these services than any other developed nation) is useless! Investments should rather be targeted towards meaningful social intervention. Till then to call anything ‘the most significant accomplishment’ is at best, over ambitious.

is setting new standards on other fronts – drug abuse, single parenthood, teen pregnancy, youth delinquency, homicide, and suicide are rampant and ubiquitous. And these are some of ‘the’ very reasons of such below average student performances, as the institution of family – just like a school– is pivotal in shaping an individual. No matter how much is invested, a fractured family at best can give a fractured individual. So, howsoever benevolent the vision, blindly investing more and more in education, and that too in meaningless ancillary services like transport, meals, housing et al (US spends on an average double on these services than any other developed nation) is useless! Investments should rather be targeted towards meaningful social intervention. Till then to call anything ‘the most significant accomplishment’ is at best, over ambitious.

For complete IIPM article click here

Source:- IIPM Editorial

Visit also:- IIPM Publication, Business & Economy & Arindam Chaudhuri Initiative

is setting new standards on other fronts – drug abuse, single parenthood, teen pregnancy, youth delinquency, homicide, and suicide are rampant and ubiquitous. And these are some of ‘the’ very reasons of such below average student performances, as the institution of family – just like a school– is pivotal in shaping an individual. No matter how much is invested, a fractured family at best can give a fractured individual. So, howsoever benevolent the vision, blindly investing more and more in education, and that too in meaningless ancillary services like transport, meals, housing et al (US spends on an average double on these services than any other developed nation) is useless! Investments should rather be targeted towards meaningful social intervention. Till then to call anything ‘the most significant accomplishment’ is at best, over ambitious.

is setting new standards on other fronts – drug abuse, single parenthood, teen pregnancy, youth delinquency, homicide, and suicide are rampant and ubiquitous. And these are some of ‘the’ very reasons of such below average student performances, as the institution of family – just like a school– is pivotal in shaping an individual. No matter how much is invested, a fractured family at best can give a fractured individual. So, howsoever benevolent the vision, blindly investing more and more in education, and that too in meaningless ancillary services like transport, meals, housing et al (US spends on an average double on these services than any other developed nation) is useless! Investments should rather be targeted towards meaningful social intervention. Till then to call anything ‘the most significant accomplishment’ is at best, over ambitious.For complete IIPM article click here

Source:- IIPM Editorial

Visit also:- IIPM Publication, Business & Economy & Arindam Chaudhuri Initiative